Reports

Published: 2025-08-28 09:00:00

The fiscal year of 2024-2025 has been extremely productive in Hamlet BioPharma, including the fourth quarter (Q4). The company has successfully completed Phase II studies of cancer and infection, secured drug production in preparation for Phase III trials, extended the patent portfolio and secured funding, short and long term. These advances identify the company as a mature drug development organization, setting the stage for the commercialization of the advanced projects and efficient development of the rich project portfolio of validated and promising new drug candidates.

After the end of the period. On July 18, 2025, we announced a directed share issue, which was approved by the Extraordinary General Meeting held on August 11, 2025. The issue of shares and warrants (units) initially provided the company with SEK 30 million and, upon full exercise of the warrants, may provide an additional capital injection of approximately SEK 110 million. In total, the company could thus receive up to SEK 140 million in new capital. We are extremely grateful for the strong investor support for Hamlet BioPharma and our portfolio of drug candidates. So far, the company has invested just over SEK 220 million and delivered three documented successful Phase II studies, including a cancer project in fast-track for market approval in the USA. We are humbly grateful for the trust in the company and will continue to use our capital efficiently for the optimal deve- lopment and commercialization of our drugs. In parallel, we continue dialogues with several actors about potential collaborations and partnerships that can accelerate the projects.

Hamlet BioPharma’s drug candidate Alpha1H has shown effective tumor-killing capabilities against many different cancer cells and demonstrated strong efficacy in a completed a Phase II clinical trial of non-muscle invasive. The clinical part of the trial was completed at the end of December 2024 and data analysis during Q4, including extensive characterization of the tumor response in molecular detail. The complete clinical study report was finalised and submitted to the FDA during Q4 and a summary of the successful outcomes was communicated.

The clinical effects of immunotherapy are ground-breaking. The data shows that bacterial infections can be treated by targeting the disease response rather than the bacteria. Comparing the IL-1 receptor antagonist anakinra to antibiotics in a randomized study, both treatments showed similar efficacy, confirming the great potential of this approach, with some advantages of immune-therapy. The IL-1 receptor antagonist inhibits the overactive immune response that drives the disease in patients with acute cystitis and reduces the symptoms, but also restores the patient’s ability to remove the bacteria. Additionally, immunotherapy shows effects against chronic pain in patients with bladder pain syndrome. Clinical data show a reduction in pain score and an improved quality of life in patients treated with anakinra.

Advances of the project portfolio include novel immunotherapeutic agents for the treatment of bacterial infections, with potent therapeutic effects in animal models of infection, including antibiotic-resistant strains of the common pathogen Escherichia coli. Efficacy of antibacterial peptides that kills normal and antibiotic-resistant strains of Mycobacterium tuberculosis was also demonstrated during Q4.

Our investor relations strategy includes monthly digital meetings and quarterly press conferences, allowing investors and other interested parties to follow the commercial progress and interact with scientists and specia- lists in the HAMLET BioPharma organization network. The format favors transparency and open discussion of relevant issues.

Looking ahead, we remain committed to advancing our clinical programs and expanding our pipeline of innovative therapies to improve patient outcomes. Our goal is to complete Phase III trials and obtain market approval, partner late-stage assets, and enable global commercialization of Phase III-ready programs.

We are grateful for the continuing support of our shareholders and the dedication of our multi-national team, as well as our external partners and collaborators.

Gabriela Godaly Catharina Svanborg

Chairman of the Board CEO

On October 1, 2024, Hamlet BioPharma invited to a digital event to be held October 9th, where results from the company’s recently completed Phase II clinical study of recurrent acute cystitis was presented. The study compared the effects of immunotherapy with antibiotic treatment in patients with recurrent bacterial infections.

On October 8, 2024, Hamlet Biopharma published a summary of the company’s three Phase II studies showing positive results for patients with recurrent acute cystitis treated with the Interleukin-1 receptor inhibitor anakinra, positive results for patients with severe bladder pain treated with the same substance, and positive results for patients with bladder cancer treated with the tumor-killing substance Alpha1H.

On October 24, 2024, the company published a notice of annual general meeting in Hamlet BioPharma AB, scheduled to take place on November 21th at 15:00 in Malmö.

On October 31, 2024, Hamlet BioPharma published the annual report for the fiscal year 2023/2024.

On November 4, 2024, Hamlet BioPharma was featured in CEO World Magazine, renowned for its focus on high-level executives and influential business leaders, in their latest Company Spotlight. They highlighted Hamlet BioPharma´s recent clinical trials and innovative approach merging groundbreaking research with a strong business vision.

The featured articles can be read here:

On November 14, 2024, Hamlet BioPharma invited to a press briefing set to take place on November 18 to present the Q1 report for the 2024/2025 financial year.

On November 15, 2024, Hamlet BioPharma released Q1 Interim Report July 2024 – September 2024

On November 19, 2024, Hamlet BioPharma announced its participation in the BioStock Life Science Summit 2024 set to take place on November 20-21 2024.

On November 21, 2024, Hamlet BioPharma published the communiqué from the Annual General Meeting of Hamlet BioPharma AB held on November 21, 2024.

On November 28, 2024, Hamlet BioPharma announced its participation in Økonomisk Ugebrev’s Life Science Investor Konference 2024 held on November 27 2024.

On December 3, 2024, Hamlet BioPharma announced that the Board of Directors has decided on a directed new issue of Class B shares amounting to just over SEK 26 million. The Directed Issue was carried out based on the authorization granted by the Annual General Meeting on November 21, 2024. The subscription price in the Directed Issue was set at SEK 2.70 per share and was determined by the Board. The shares were directed to fifteen private investors and family offices. Through the Directed Issue, Hamlet BioPharma raised SEK 26,790,008 before transaction costs.

The primary reason for conducting the Directed Issue is to finance Hamlet BioPharma’s commercialization plan, which includes investments to establish commercial partnerships and to continue investing in clinical studies, particularly for the three drug candidates that have demonstrated successful Phase II results, namely:

On December 10, 2024, Hamlet BioPharma announced that the company will present at the Financial Stockholm event on December 11, 2024.

On January 10, 2025, Hamlet BioPharma announced the continuation of the digital event series in the spring of 2025.

The meeting focused on Genetic sequencing technologies and biomarkers, with a presentation by Ass Professor Farhan Haq.

On February 3, 2025, Hamlet BioPharma announced its participation in the Swedish Research Council’s con- ference on antibiotic resistance on February 6, 2025, where the company presented on the topic ‘Attacking the Disease Instead of the Bacteria – Immunomodulation as an Alternative to Antibiotics.’ Addition- ally, on January 29, 2025, the company took part in Aktiespararna’s digital Life Science-themed evening, where the latest developments were presented (see video at: https://hamletbiopharma.com/news/media- archive/).

On February 12, 2025, Hamlet BioPharma invited to digital investor meeting on the 13th of February 2025.

On February 13, 2025, Hamlet BioPharma published the Q2 Interim report October – December 2024. The presentation at the digital Q2 meeting focused on the progress of non-antibiotic treatment strategies developed by the company and on the positive outcomes of the Phase II study in patients with recurrent acute cystitis.

On February 18, 2025, the Board of Hamlet BioPharma decided to appoint Catharina Svanborg as CEO. Catharina immediately assumes the CEO role and continues as a Board member. Martin Erixon left the CEO role and will be at the company’s disposal during his notice period. Board member Magnus Nylén was appointed by the board as temporary chairman of the board. The board decided to call an extraordinary general meeting to propose Professor Gabriela Godaly to be elected as a new board member and Chairman of the board.

On February 19, 2025, Hamlet BioPharma appointed Elisabeth Parker, PhD to strengthen the business development expertise in the company. Dr. Parker has 25 years’ experience of R&D, partnering and commercialization of therapeutics, diagnostics and enabling technologies. Dr. Parker leaves her current position as Senior Investment Advisor Healthcare and Life Sciences at Business Sweden to take up the 80% position with Hamlet BioPharma. Elisabeth Parker will leave the board of Hamlet BioPharma at the upcoming extra- ordinary general meeting as she now takes on a management role in the company.

On February 20, 2025, the board of Hamlet BioPharma proposed a licensing agreement with Linnane Pharma, which creates conditions for an effective commercialization of Bamlet and positive value for both companies. The Licensing agreement enables Linnane Pharma to commercialize products based on Bamlet, with the help of the supplementary patents, which are licensed from Hamlet BioPharma. In brief, through the licensing agreement Hamlet BioPharma will receive a royalty payment from Linnane Pharma of 25 percent of future revenues from the sale of products and other revenues such as license fees based on Bamlet. Linnane Pharma’s obligation to pay royalty compensation to Hamlet BioPharma applies according to the Licensing Agreement until and including the time when Linnane Pharma’s patent regarding Bamlet expires, which is in 2044.

On February 20, 2025, Hamlet BioPharma called for an Extraordinary General Meeting in Hamlet BioPharma AB to be held on March 11th, 2025.

On February 21, 2025, Hamlet BioPharma invited to digital investor meetings taking place on the 21st of February 2025 for discussions of the licensing agreement.

On March 11, 2025, a Communiqué from the Extraordinary General Meeting of Hamlet BioPharma AB was announced, including the approval of the licensing agreement on Bamlet between Hamlet BioPharma and Linnane Pharma and the election of Gabriela Godaly to the board and to the position as Chairman of the Board.

On March 12, 2025, Hamlet BioPharma invited to investor meeting on March 12th, 2025. Discussion about the licensing agreement and novel discoveries of Bamlet’s beneficial effects on metabolic health in animal models.

On April 7, 2025, Hamlet BioPharma, announced that Hamlet BioPharma’s drug candidate Alpha1H has shown potent treatment effects in patients with cancer of the urinary bladder. The final analysis of the placebo- controlled, dose-escalation and repeated treatment study parts, confirmed the strong treatment effects compared to placebo. The Clinical study report is being completed for submission to the FDA.

On April 7, 2025, Hamlet BioPharma announced new granted patents added to Hamlet BioPharma’s extensive patent portfolio in cancer and infection. Hamlet BioPharma’s extensive patent portfolio comprises 147 granted patents and 33 pending cases. Strategy regarding intellectual property rights, follow up and extension of filed cases and patenting of new discoveries is overseen by the internationally established legal firm Greaves-Brewster LLP, who have advised Hamlet BioPharma since the start.

On April 8, 2025, Hamlet BioPharma announced the publication of new scientific advances important for the mechanism of action of Alpha1H in the treatment of bladder cancer, in collaboration with scientists at Lund University. A summary of the study, investigating the mechanism of action of Alpha1H, using high resolution imaging technology, was published on March 25th, 2025 in Life Science Alliance by the team at Lund University, associated with Hamlet BioPharma. Link to the article: https://www.life-science-alliance.org/content/8/6/ e202403114.

On May 2, 2025, Hamlet BioPharma AB announced that the company’s drug candidate Alpha1H has been presented at the American Association for Cancer Research (AACR) Annual Meeting 2025 in Chicago, USA. AACR is one of the world’s most prestigious scientific conferences in the field of cancer and the company’s allocation of space at the meeting underlines the significance of Hamlet BioPharma’s progress. Link to the abstract: https://www.abstractsonline.com/pp8/#!/20273/presentation/10519.

On May 19, 2025, In collaboration with Lund University, a new study (published in Life Science Alliance) has revealed how Alpha1H acts inside tumor cells (New scientific advances for Alpha1H highlight the unique discovery pipeline and drug development potential for the treatment of bladder cancer - Hamlet BioPharma). The research shows that Alpha1H targets the endoplasmic reticulum (ER) – a vast membrane system in the cell – and remodels this structure. The process can be compared to a fishing net being tightened around its contents, which helps dying tumor cells encapsulate toxic components. This mechanism may explain why Alpha1H effectively kills tumor cells while sparing healthy tissue.

On June 17, 2025, Hamlet BioPharma announced progress in Tuberculosis therapy

On June 25, 2025, Hamlet BioPharma held a Successful In Person Meeting with US FDA

The Hamlet team summarized the scientific and clinical background and presented data from Hamlet’s successful and recently completed Phase II study (Dec 2024). The impressive data to date in the Alpha1H program was well received by the FDA and the fruitful discussion included the clinical team in Prague and Target Health’s regulatory expertise and leadership.

The company remains on track to initiate the Phase III trial, subject to final protocol agreement and regulatory clearance. The meeting marked a key milestone in the regulatory pathway and provided an opportunity to align with the FDA on key aspects of the trial design.

On July 18, 2025, Hamlet BioPharma proposes to raise capital through a directed new issue of B shares with associated warrants (so-called units). A unit consists of a B share with a short and a longer warrant. The issue initially adds just over SEK 30 million and, if the warrants are fully exercised, can provide a further capital injection of a total of approximately SEK 110 million, which means that the company can add up to SEK 140 million in new capital in total. The issue is aimed at approximately 20 external investors and the subscription price per unit is SEK 4.30. The subscription price corresponds to the average volume-weighted share price during 30 trading days of SEK 4,30. The subscription price for the short option that runs for 12 months is SEK 6 per share and the subscription price for the long option that runs for 30 months is SEK 10 per share. Dilution after full subscription is calculated at just over 10%. Hamlet BioPharma has received binding subscription commitments from all external investors.

On July 24, 2025, Hamlet BioPharma called for an Extraordinary General Meeting in Hamlet BioPharma AB to be held on August 11th, 2025 and a digital meeting on the 25th of July.

On August 11, 2025, Hamlet BioPharma, announced that the extraordinary general meeting decided to approve the board’s proposal for a directed new issue of shares and warrants (units). The issue initially provides the company with SEK 30 million and, if the warrants are fully exercised, may provide an additional capital injection of approximately SEK 110 million. This means that the company can be provided with a total of up to SEK 140 million in new capital.

On August 21, 2025, Hamlet BioPharma Announces the Completion of the Alpha 1H Phase II Study in Non- Muscle Invasive Bladder Cancer. The completion of the successful Phase II clinical trial of the company’s drug candidate Alpha1H in patients with cancer in the urinary bladder. The final clinical study report based on extensive analyses of clinical and laboratory data highlights the potent treatment effects. All primary and secondary endpoints of safety and efficacy were reached.

Hamlet BioPharma is a drug company focused on the development of innovative treatments for cancer and infectious diseases. With a mission to address large, unmet medical needs, the company has built a robust pipeline of therapeutic candidates targeting malignant tumors and antibiotic-resistant infections. These achieve- ments underscore Hamlet BioPharma’s potential as a leader in innovative drug development, advancing novel therapies that address critical healthcare demands globally.

PIPELINE – OVERVIEW HAMLET BIOPHARMA

| Clinical | ||

| Alpha1H | Bladder cancer | Phase II |

| Phase II: | ||

| IL-1 receptor antagonist | Infection and inflammation |

|

| Preclinical | ||

| Alpha1H | Brain tumor | Positive data in animal model, development of technology |

| Hamlet | Colon and rectal cancer | Positive data in animal model |

| Hamlet | Oral cancer | Preclinical evaluation |

| RNA Pol II inhibitor - protein | Preventive anti-inflammatory and antibacterial effects | Positive data in animal model, development of technology. Preparation of substance for clinical studies |

| Anti-TBC peptide | Pulmonary tuberculosis | Positive data in animal model, development of technology for drug production |

| NK1R-receptor antagonist | Pain and nerve activation inhibitors | Positive data in animal model, development of technology. Preparation of substance for clinical studies |

| RNA Pol II inhibitor - bacteria | Prevention of inflammation and treatment of infection | Positive data in animal model, development of technology |

| IRF7 inhibitor, siRNA | Inhibits severe bacterial infections | Positive data in animal model, technology development. Data to support the development of drugs for clinical trials |

Significant progress has been made in several projects.

The structural and molecular basis of NlpD’s protective effects has been defined as well as its potent therapeutic effects in bacterial infection models. Our approach is to identify and use molecules from the microbiome that protect mucosal tissues from external threats, including pathogenic bacteria. The bacteria in the normal flora, that form the microbiome, offer a great source to find new solutions to gain control over the host immune system and treat infections. Molecules with beneficial properties can be explored as novel therapeutic agents against infection. This includes molecules that specifically modify the host immune system as well as their targets in human cells.

The NlpD protein from bacteria inhibits destructive innate immune responses in animal models of urinary tract infection. To understand the mechanism, the molecular basis of this effect has been investigated. One peptide domain of NlpD has been shown to enter human cells and target constituents of the Pol II activation complex, which controls gene expression including the overactivation of the immune response to infection. The protective potential of LytM was investigated in an in vivo model of urinary tract infection, where LytM treatment virtually abolished tissue pathology and accelerated bacterial clearance. This effect included antibiotic-resistant strains, suggesting that NlpD and the LytM peptide, should be explored to achieve Pol II inhibition and protection against bacterial infections.

These studies provide a necessary basis for the clinical development of NlpD, as a basis for production methods, toxicology and defining target populations.

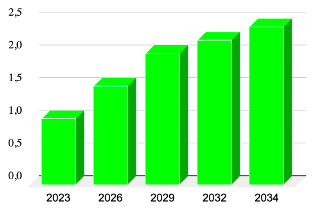

The fungal peptide NZ2114 has been identified as a promising candidate therapeutic against Mycobacterium tuberculosis, making it a strong candidate for future TB treatment strategies.

The global demand for effective cancer therapies and alternative treatments for infections is expanding, and Hamlet BioPharma’s drug candidates are well-positioned to capture substantial shares within these high- growth markets. With innovative solutions that align with current healthcare priorities, Hamlet BioPharma is addressing essential needs while positioning itself for sustainable growth.

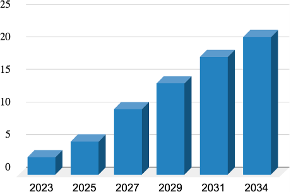

Market Growth and Demand for Alternatives: Bladder cancer has one of the highest recurrence rates, with non-muscle invasive bladder cancer (NMIBC) being particularly challenging. This cancer type often requires repeated treatments, which are costly and have limited effectiveness. According to Transparency Market Research, the NMIBC market is projected to grow from USD 2.6 billion in 2023 to an estimated USD 21.1 billion by 2034, at a compound annual growth rate (CAGR) of 21.4%. This growth is driven by an increasing focus on immunotherapies and the need for more effective, less invasive treatments.

Source:Transparency Market Research; https://www.transparencymarketresearch.com/ non-muscle-invasive-bladder-cancer-market.html

Alpha1H’s Market Position: Alpha1H, with its promising clinical outcomes and immune activation profile, is uniquely suited to the need for new NMIBC treatment. As a Fast Track-designated therapy with documented anti-tumor effects, Alpha1H stands to become a valuable asset, in the global oncology market. Its innovative mechanism of action—targeting cancer cells while preserving healthy tissue—could make it a preferred alternative to traditional treatments, which are often associated with higher toxicity and frequent recurrences.

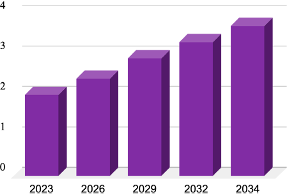

Market Differentiation: By focusing on an immunomodulatory approach, Hamlet BioPharma is offering an innovative solution to address the problem of antibiotic resistance. This treatment modality represents a paradigm shift in managing bacterial infections. By targeting the disease response, patient health can be improved and bacteria removed by normal defense mechanisms, rather than directly targeting the bacteria. In this way, infections caused by antibiotic resistant and antibiotic sensitive organisms can be targeted in animal models. This approach also reduces the selective pressure that contributes to resistance in the environment and general population.

Source:Data are estimated values to represent market development from reports and research from the American Urological Association (AUA) and International.

Hamlet BioPharma has engaged in strategic collaborations with leading international advisory firms, to identify partners for the commercialization of company assets. These partnership strategies have placed Hamlet Bio- Pharma on the map of the pharmaceutical industry, nationally and internationally. Discussions focus on the lead compound Alpha1H, recent positive Phase II data as well as the immunotherapy projects and the portfolio of preclinical projects, to identify new partnerships and strengthen existing networks.

FINANCIAL OVERVIEW

The period in summary

FOURTH QUARTER, APR 1, 2025-JUN 30, 2025 (THE PARENT COMPANY)

– Net sales totaled KSEK 0 (0)

– EBITDA amounted to KSEK -15,159 (-9,168)

– EBIT amounted to KSEK -17,219 (-11,303)

– Net result amounted to KSEK -16,998 (-11,040)

– Earnings Per Share* was SEK -0.0957 (-0.0658) and -0.0856 after dilution

FULL YEAR, JUL 1, 2024-JUN 30, 2025 (THE PARENT COMPANY)

– Net sales totaled KSEK 0 (0)

– EBITDA amounted to KSEK -44,663 (-32,929)

– EBIT amounted to KSEK -53,131 (-40,539)

– Net result amounted to KSEK -52,657 (-39,822)

– Earnings per share* was SEK -0.2964 (-0.2374) and -0.2651 after dilution

– On June 30, 2025, the equity/assets ratio** was 84.9 (94.2) %

– Cash amounted to KSEK 10,735 (23,076)

FOURTH QUARTER, APR 1, 2025-JUN 30, 2025 (THE GROUP)

– Net sales totaled KSEK 0 (0)

– EBITDA amounted to KSEK -15,159 (-9,168)

– EBIT amounted to KSEK -17 ,718 (-11,802)

– Net result amounted to -17,496 (11,539) KSEK

– Earnings Per Share* was SEK -0.0985 (-0.0688) and -0.0881 after dilution

FULL YEAR, JUL 1, 2024-JUN 30, 2025 (THE GROUP)

– Net sales totaled KSEK 0 (0)

– EBITDA amounted to KSEK -44,663 (-32,930)

– EBIT amounted to KSEK -55,126 (-42,534)

– Net result amounted to KSEK -54,653 (-41,817)

– Earnings per share* was SEK -0.3076 (-0.2493) and -0.2752 after dilution

– On June 30, 2025, the equity/assets ratio** was 83.3 (94.0) %

– Cash amounted to KSEK 10,760 (23,101)

Amounts in parentheses above and below indicate the corresponding value in the preceding year.

EBITDA = Earnings Before Interest, Tax, Depreciation and Amortization

EBIT = Operating result, Earnings Before Interest and Tax.

* Earnings per share for the period divided by 177,685,127 (167,762,902), respectively 198 615 359, where 177,685,127 is the number of shares outstanding on June 30, 2025, and 198 615 359 shares constitute the number of shares that the Company will have if all subscribed units in the rights issue are paid and exercised. The comparative figure in parentheses was the number of shares on June 30, 2024

** Equity divided by total capital.

Hamlet Biopharma is specializing in the development of drugs with a broad and strong portfolio of projects for the treatment of cancer and infections. The company remains pre-revenue, with value creation driven by milestones in development and partnerships. Net sales amounted to KSEK 0 (0) during the fourth quarter, and to KSEK 0 (0) during the full year. Other operating income amounted to KSEK 0 (0) during the quarter, and to KSEK 208 (30) during the full year.'

Earnings

External costs were related to the continued drug development activities of the research team at Lund University. The team at Lund University is also responsible for the development of manufacturing methods, stability testing, and chemical and functional characterization of existing and new drug substances and plays a key role in the coordination of laboratory testing in the clinical trial. EBITDA for the quarter amounted to KSEK -15,159 (-9,168) and for the full year KSEK -44,663 (-32,929). The depreciations in the quarter was

KSEK -2,060 (-2,135) and for the full year KSEK -8,467 (-7,609). EBIT for the quarter amounted to KSEK -17,219 (-11,303) and for the full year to KSEK -53,131 (-40,539). Net result for the quarter was KSEK -16,998 (-11,040) in the quarter and KSEK -52,657 (-39,822) for the full year.

After the period, on August 11, the extraordinary general meeting resolved to approve the Board of Directors’ proposal for a directed issue of shares and warrants (units). The issue initially provides the company with MSEK 30 million and, upon full exercise of the warrants, may provide an additional capital injection of approxi- mately MSEK 110 million. In total, the company may thus be provided with up to MSEK 140 million in new capital. Dilution after full subscription is estimated at 10%.

At the end of the fourth quarter, the equity/assets ratio was 84.9 (94.2) %, and the Company’s cash and cash equivalents were KSEK 10,735 (23,076).

The Company successfully completed a directed rights issue during December 2024, which raised MSEK 26.5 for the Company after issue costs of only KSEK 277.

The Company does not capitalize expenses for research and development as assets, since the Company is in an R&D stage. R&D costs are therefore recognized as operating expenses in the income statement.

During the quarter, depreciation of equipment amounted to KSEK 39 (113), and the depreciation of patents from the merger with SelectImmune Pharma AB amounted to KSEK 2,021 (2,021).

In the group, depreciation of patents, including the acquisition of Linnane Projects AB, amounted to KSEK 2,520 (2,520) during the quarter.

Employees

The company had the equivalent of 8 (7) full-time employees during the quarter.

The Company’s shares have been traded on Spotlight Stock Market since October 23, 2015. The B-share is traded under the short name “HAMLET B” with ISIN code SE0015661152 and the A-share is not listed. Each A-share entitles to ten votes and B-shares entitles to one vote. Furthermore, it is possible for shareholders to convert A-shares to B-shares, which can be traded on Spotlight Stock Market. This conversion program is ongoing with no current deadline. This means that the ratio between A- and B-shares will change over time.

As of June 30, 2025, the number of shares registered at the Swedish Companies Registration Office (Bolagsverket) totaled 177,685,127. The registered current ratio of shares was 39,947,938 A-shares and 137,737,189 B-shares.

The company had no outstanding warrants as of June 30, 2025.

After the financial year, on August 11, 2025, the extraordinary general meeting decided to approve the board’s proposal for a directed new issue of shares and warrants (units). The warrants in serie TO5B and serie TO6B give the right to subscribe for a total of 6 976 744 shares, respectively. Subscription for shares in serie TO5B shall be possible during the period 2026-07-20 - 2026-07-31 at a subscription price of SEK 6 per share. Subscription for shares in serie TO5B shall be possible during the period 2028-01-17 – 2028-01-31 at a subscription price of SEK 10 per share.

During the quarter, KSEK 1,459 (1,370) was paid to Linnane Pharma AB, of which KSEK 1,339 (1,250) refers to the new co-operation agreement, KSEK 120 (120) refers to patent license.

The consulting fees to Linnane Pharma AB refers to compensation for the collaboration agreement access to advanced science and cutting-edge technology for drug development. The collaboration means that Linnane Pharma’s technology platform and other resources are available to Hamlet BioPharma. Hamlet BioPharma is a subsidiary company of Linnane Pharma AB, which owns 33.38% of the capital and 74.61% of the votes of Hamlet BioPharma.

Furthermore, salaries and allowances to the board and management were paid during the period. Transactions with related parties is on market terms.

The Board’s assessment of significant risks and uncertainties is unchanged compared with the most recent financial year and are described in the most recently published annual report (2024-06-30).

The Company prepares its accounts in accordance with the Swedish Annual Accounts Act (Årsredovisnings- lagen) and the K3 framework (BFNAR 2012:1) of the Swedish Accounting Standards Board (Bokföringsnämnden).

The company’s accounting principles are unchanged compared with most recent financial year and are described in the most recent published annual report (2024-06-30).

On March 31st, 2023, Hamlet BioPharma acquired Linnane Projects AB from Linnane Pharma AB and the patents and know-how regarding a new peptide-based drug against tuberculosis as well as the know-how required to develop the project. In accordance with regulations at Spotlight and the Swedish Accounting Standards Board (Bokföringsnämnden), consolidated accounts of Linnane Projects and Hamlet BioPharma are drawn up. The quarterly report is prepared with the parent company’s accounting in focus. In texts, the group is only commented on if something differs significantly from the parent company.

Review

This interim report has not been audited.

Annual report for 2024/2025 October 31, 2025

Interim report for Q1, 2025/2026 November 14, 2025

Annual General Meeting for 2024/2025 December 4, 2025

INCOME STATEMENT: THE PARENT COMPANY

| SEK | 2025-04-012025-06-30 | 2024-04-012024-06-30 | 2024-07-012025-06-30 | 2023-07-012024-06-30 |

| Net sales | 0 | 0 | 0 | 0 |

| Other operating income | 0 | 0 | 208 038 | 29 971 |

| Operating income | 0 | 0 | 208 038 | 29 971 |

| Other external costs | -13 114 002 | -7 155 732 | -36 882 334 | -25 220 121 |

| Employee benefit expenses | -2 041 502 | -1 992 357 | -7 935 277 | -7 712 231 |

| Depreciation of assets | -2 060 442 | -2 135 041 | -8 467 222 | -7 609 148 |

| Other operating expenses | -3 688 | -20 387 | -53 767 | -27 545 |

| Operating result, EBIT | -17 219 635 | -11 303 517 | -53 130 563 | -40 539 074 |

| Financial items | 222 122 | 263 179 | 472 708 | 717 413 |

| Earnings before tax | -16 997 513 | -11 040 338 | -52 657 855 | -39 821 661 |

| Tax on loss for the period | 0 | 0 | 0 | 0 |

| Net earnings | -16 997 513 | -11 040 338 | -52 657 855 | -39 821 661 |

BALANCE SHEET: THE PARENT COMPANY

| SEK | 2025-06-30 | 2024-06-30 |

| ASSETS | ||

| Fixed assets | ||

| Intangible assets | 25 125 056 | 33 210 260 |

| Tangible assets | 217 160 | 574 256 |

| Financial assets | 10 000 000 | 10 000 000 |

| Total fixed assets | 35 342 216 | 43 784 516 |

| Current assets | ||

| Other receivables | 1 564 911 | 3 727 639 |

| Prepaid expenses | 430 274 | 471 474 |

| Cash and bank balances/financial investments | 10 735 539 | 23 076 079 |

| Total current assets | 12 730 724 | 27 275 192 |

| Total assets | 48 072 940 | 71 059 708 |

| EQUITY & LIABILITIES | ||

| Restricted equity | ||

| Share capital | 1 776 851 | 1 677 629 |

| Statutory reserve | 20 000 | 20 000 |

| Total restricted equity | 1 796 851 | 1 697 629 |

| Non-restricted equity | ||

| Share premium reserve | 251 751 833 | 225 337 658 |

| Retained earnings | -160 083 493 | -120 261 832 |

| Loss for the period | -52 657 855 | -39 821 661 |

| Total non-restricted equity | 39 010 485 | 65 254 165 |

| Total equity | 40 807 337 | 66 951 794 |

| Current liabilities | ||

| Accounts payable | 2 892 898 | 1 230 214 |

| Tax liabilities | 160 543 | 181 994 |

| Other liabilities | 358 148 | 297 279 |

| Accrued expenses | 3 854 014 | 2 398 427 |

| Total current liabilities | 7 265 604 | 4 107 914 |

| Total Equity & Liabilities | 48 072 940 | 71 059 708 |

CASH FLOW STATEMENT: THE PARENT COMPANY

| SEK | 2024-07-012025-06-30 | 2023-07-012024-06-30 |

| Operating activities | ||

| Loss after financial items | -52 657 855 | -39 821 661 |

| Adjusted for non-cash items, etc. | 8 467 222 | 5 838 114 |

| Cash flow from operating activities before changes in working capital | -44 190 633 | -33 983 547 |

| Cash flow from changes in working capital | ||

| Change in current receivables | 2 203 928 | -3 577 882 |

| Change in current liabilities | 3 157 690 | 1 559 340 |

| Cash flow from operating activities | -38 829 015 | -36 002 089 |

| Investing activities | ||

| Acquisition of tangible assets | -24 922 | -278 085 |

| Cash flow from investing activities | -24 922 | -278 085 |

| Financing activities | ||

| Rights issue | 26 790 008 | 46 767 318 |

| Issuance costs | -276 610 | -4 314 233 |

| Amortization of loans | 0 | -5 000 000 |

| Merger with SelectImmune Pharma AB | 0 | 3 535 312 |

| Cash flow from financing activities | 26 513 398 | 40 988 397 |

| Cash flow for the period | -12 340 540 | 4 708 224 |

| Cash and cash equivalents at the beginning of the period | 23 076 079 | 18 367 855 |

| Cash and cash equivalents at the end of the period | 10 735 539 | 23 076 079 |

EQUITY: THE PARENT COMPANY

| SEK | Share capital | Statutory reserve | Share premium reserve | Retained earnings | Loss for the period | Total |

| Opening balance July 1, 2024 | 1 677 629 | 20 000 | 225 337 658 | -120 261 832 | -39 821 661 | 66 951 794 |

| Transfer of prior year’s loss | -39 821 661 | 39 821 661 | 0 | |||

| Rights issue | 99 222 | 26 414 175 | 26 513 398 | |||

| Loss for the period, Q1 | -9 765 592 | -9 765 592 | ||||

| Loss for the period, Q2 | -13 888 017 | -13 888 017 | ||||

| Loss for the period, Q3 | -12 006 733 | -12 006 733 | ||||

| Loss for the period, Q4 | -16 997 513 | -16 997 513 | ||||

| Equity June 30, 2025 | 1 776 851 | 20 000 | 251 751 833 | -160 083 493 | -52 657 855 | 40 807 337 |

INCOME STATEMENT: THE GROUP

| SEK | 2025-04-012025-06-30 | 2024-04-012024-06-30 | 2024-07-012025-06-30 | 2023-07-012024-06-30 |

| Net sales | 0 | 0 | 0 | 0 |

| Other operating income | 0 | 0 | 208 038 | 29 971 |

| Operating income | 0 | 0 | 208 038 | 29 971 |

| Other external costs | -13 114 002 | -7 155 732 | -36 882 334 | -25 220 121 |

| Employee benefit expenses | -2 041 502 | -1 992 357 | -7 935 277 | -7 712 231 |

| Depreciation of assets | -2 559 192 | -2 633 791 | -10 462 222 | -9 604 148 |

| Other operating expenses | -3 688 | -20 387 | -53 767 | -27 545 |

| Operating result, EBIT | -17 718 385 | -11 802 267 | -55 125 563 | -42 534 074 |

| Financial items | 222 122 | 263 179 | 472 708 | 717 413 |

| Earnings before tax | -17 496 263 | -11 539 088 | -54 652 855 | -41 816 661 |

| Tax on loss for the period | 0 | 0 | 0 | 0 |

| Net earnings | -17 496 263 | -11 539 088 | -54 652 855 | -41 816 661 |

| Attributable to | ||||

| The parent company's shareholders | -17 496 263 | -11 539 088 | -54 652 855 | -41 816 661 |

| Holdings without controlling influence | 0 | 0 | 0 | 0 |

BALANCE SHEET: THE GROUP

| SEK | 2025-06-30 | 2024-06-30 |

| ASSETS | ||

| Fixed assets | ||

| Intangible assets | 30 611 306 | 40 691 510 |

| Tangible assets | 217 160 | 574 256 |

| Financial assets | 0 | 0 |

| Total fixed assets | 30 828 466 | 41 265 766 |

| Current assets | ||

| Other receivables | 1 564 911 | 3 727 639 |

| Prepaid expenses | 430 274 | 471 474 |

| Cash and bank balances/financial investments | 10 760 539 | 23 101 079 |

| Total current assets | 12 755 724 | 27 300 192 |

| Total assets | 43 584 190 | 68 565 958 |

| EQUITY & LIABILITIES | ||

| Equity | ||

| Share capital | 1 776 851 | 1 677 629 |

| Other contributed capital | 251 771 833 | 225 357 658 |

| Other equity including loss for the period | -217 230 098 | -162 577 243 |

| Total equity attributable to the parent company's shareholders | 36 318 587 | 64 458 044 |

| Holdings without controlling influence | 0 | 0 |

| Total equity | 36 318 587 | 64 458 044 |

| Current liabilities | ||

| Accounts payable | 2 892 898 | 1 230 214 |

| Tax liabilities | 160 543 | 181 994 |

| Other liabilities | 358 148 | 297 279 |

| Accrued expenses | 3 854 014 | 2 398 427 |

| Total current liabilities | 7 265 604 | 4 107 914 |

| Total Equity & Liabilities | 43 584 190 | 68 565 958 |

CASH FLOW STATEMENT: THE GROUP

| SEK | 2024-07-012025-06-30 | 2023-07-012024-06-30 |

| Operating activities | ||

| Loss after financial items | -54 652 855 | -41 816 661 |

| Adjusted for non-cash items, etc. | 10 462 222 | 7 833 114 |

| Cash flow from operating activities before changes in working capital | -44 190 633 | -33 983 547 |

| Cash flow from changes in working capital | ||

| Change in current receivables | 2 203 928 | -3 577 882 |

| Change in current liabilities | 3 157 690 | 1 559 340 |

| Cash flow from operating activities | -38 829 015 | -36 002 089 |

| Investing activities | ||

| Acquisition of tangible assets | -24 922 | -278 085 |

| Cash flow from investing activities | -24 922 | -278 085 |

| Financing activities | ||

| Rights issue | 26 790 008 | 46 767 318 |

| Issuance costs | -276 610 | -4 314 233 |

| Borrowings | 0 | -5 000 000 |

| Merger with SelectImmune Pharma AB | 0 | 3 535 312 |

| Cash flow from financing activities | 26 513 398 | 40 988 397 |

| Cash flow for the period | -12 340 540 | 4 708 224 |

| Cash and cash equivalents at the beginning of the period | 23 101 079 | 18 392 855 |

| Cash and cash equivalents at the end of the period | 10 760 539 | 23 101 079 |

EQUITY: THE GROUP

| SEK | Share capital | Other contributed capital | Other equity incl profit for the period | Total |

| Opening balance July 1, 2024 | 1 677 629 | 225 357 658 | -162 577 243 | 64 458 044 |

| Transfer of prior year’s loss | 0 | 0 | ||

| Rights issue | 99 222 | 26 414 175 | 26 513 398 | |

| Loss for the period, Q1 | -10 264 342 | -10 264 342 | ||

| Loss for the period, Q2 | -14 386 767 | -14 386 767 | ||

| Loss for the period, Q3 | -12 505 483 | -12 505 483 | ||

| Loss for the period, Q4 | -17 496 263 | -17 496 263 | ||

| Equity June 30, 2025 | 1 776 851 | 251 771 833 | -217 230 098 | 36 318 587 |

The Board of Directors and the Chief Executive Officer assure that the interim report provides a true and fair view of the Company’s operations, position, and results.

Malmö, August 28, 2025

Catharina Svanborg, CEO, Board member

Gabriela Godaly, Chairperson of the Board

Bill Hansson, Board member

Magnus Nylén, Board member